People are deeply concerned by coronavirus’s alarming level of spread and severity; the economic outlook, in many eyes, has become bleak. Yet a grocery store owner in Nanning told us: The epidemic just hit the “pause” button and everything will be back on track before we notice it. The optimistic remarks were made during his business close-down. The business owner is currently dealing with a large amount of remaining inventories, paying the rents and paychecks. The contrast of his confidence and the current situation has aroused our interest in the impact of the epidemic. For the other communities that struggles in the epidemic, especially the working class and micro-economies (In this article it refers to the economies that are small in size, such as small and micro businesses, individual businesses and family farms), are they sharing the optimistic spirit? What is the source of such optimism and confidence?

Bearing these questions in mind, we pulled off a questionnaire survey of 1,259 working class and micro-business owners through an online platform, conducted online interviews with 11 business owners, and for the first time adopted the concept of "Finance Health” to analyze how "pause" by epidemic outbreak would impact the households and businesses. As an analogy to human body, if a household or micro-economy is financially sound or healthy, it can bounce back quickly to its original state after being negatively affected. This may be the reason for some to maintain optimistic spirit even under severe epidemic scenario.

Keep up the confidence during epidemic outbreak

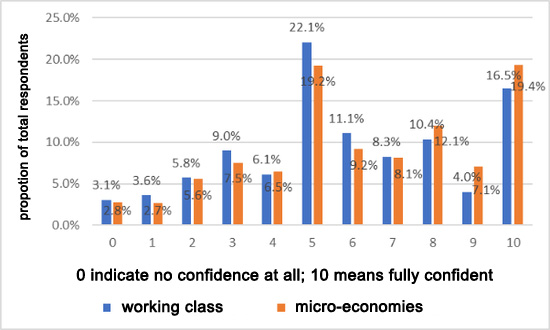

The survey was designed to use scale 0 to 10 to represent different levels of confidence (0 indicate no confidence at all; 5 is a midpoint and 10 means fully confident); The respondents were requested to score their confidence on the financial outlook of their households and businesses. 521 respondents (396 working class and 125 micro-business owners) scored on financial confidence of households; 863 micro-business owners scored their confidence of businesses. The results are shown in Figure 1, which displays a similar pattern between the two sets of data. more than 70% of the respondents rated 5 and above for their financial confidence, both in households and business outlook groups. Only about 3% of the respondents expressed their lack of confidence; Around 16.5% and 19.4% in respective groups chose to rate “highly confident" in terms of households and business outlook. Although the data for "pre-epidemic" and "post-epidemic" comparison is lacking, such high rating in both groups has indicated more positive financial outlook than expected.

Figure 1 Confidence rate on financial outlook of working class and micro-economies during epidemic outbreak

The short-term impact of the epidemic should not be underestimated

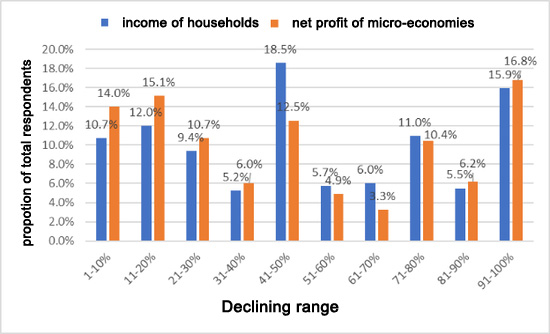

Despite the optimistic spirit, the impact can’t be ignored. In fact, over 70% of households and micro-economies reported that (Figure 2) their income in the first two months of this year decreased compared with the same period last year, of which 15.9% of households and 16.8% of micro-economies reported 90% of income fall. Nevertheless, a small number of households (1.7%) and micro-economies (5.4%) earned a blessing in disguise with increased income.

As for industries, no sectors can escape from the shock. Industries like culture, sports, entertainment, IT service and the manufacturing suffered 55-60% of income reduction, both in terms of households and businesses; while industries like agriculture, forestry, animal husbandry and fishery, construction, lodging and catering, tourism and beauty service have been affected more extensively, with nearly 80% of income decrease.

Figure 2 Declining range and distribution of income in Jan. and Feb.

Outbreak may cause structure change

The outbreak does not affect each household or economy in an equal way. 20% of households and micro-economies didn’t report any change in terms of income, and a small number of households and micro-economies even reported a claimed income increase. In contrast, more than 80% offline business entities suffered a decline in revenue, while only around 60% online businesses responded so. It should also be noted that 30% of online business entities have not been affected by the epidemic, in contrast, 10% of them bucked the trend and reported revenue increase. Taking profits and risks resistance into consideration, people may adjust their future business strategies based on the above-mentioned figures, resulting in the shift of the overall economic structure.

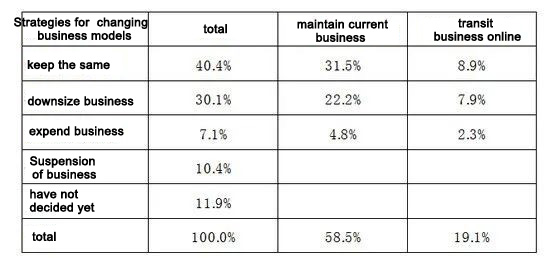

Mr. Hao from Chengdu is an example of adjusting business strategies based on the impact of the epidemic. He has been engaged in online education services. He believes that the outbreak will force offline education to go online, therefore he is planning to expand his business. The survey results have confirmed that many business owners are considering adjusting their business strategies: 19% of the respondents consider to transit business online in the next three months; 30% are going to downsize, while 7% plan to expand. It is concluded that the strategic adjustment may result in the structural change of business model, pushing more businesses online and be more compact.

Table 1 Post-outbreak business strategy transformation plan

Financial health as the solid foundation to withstand emergencies

Why can the working class and the micro-economies remain confident in financial outlook during the outbreak? By adopting the concept of “financial health”, the correlation among health, shocking events and mentality can be better explained. Financial health index was calculated among 396 working class. By analyzing the correlation of index and confidence rating, it is concluded that these two have a highly positive correlation, with a correlation coefficient of 0.604, reaching a significant level of 1%. It indicates that the higher the financial health index, the more confident households are in defending the epidemic shock.

With the same approach, the financial health of micro-economies was examined. The results indicate that financial health has a similar significant effect on their risk resistance. The financial confidence of business operation is positively correlated to its financial health index, with coefficient of 0.617. It can be concluded that fostering the financial health of households and micro-economies has significant impact on resisting disasters such as coronavirus. It can be described as "leveraging financial health to counter the coronavirus threat".

How to improve financial health

To improve financial health, it is essential to understand its connotation. Financial health sets a higher bar for inclusive finance: financial services cannot lead to adverse consequences such as over-indebtedness, which might put consumers in unhealthy financial status; it shall not impose adverse effect on consumers’ goal to pursue better life. Financial health embraces sound savings and consumption habits; higher credit awareness and financial literacy, as well as stronger capacity to buffer economic fluctuations. Financial health is fundamental to rid poverty and improve life quality, and the index is evaluated via six aspects:whether the consumers have a balanced revenue and expenditure; whether their debt is well managed; whether they have financial reserves; whether they have financial plans; whether they have plans to buffer economic shocks; whether they can utilize various financial instruments in an effective way, etc. The above-mentioned scopes give a hint of how financial health can be improved among consumers.

First, we must vigorously develop inclusive finance, improve the accessibility, utilization rate and quality of financial services, in hope that low-income households and micro-economies can utilize financial services as a tool to resist risks when in need. An essential approach is to build a financial ecosystem that is beneficial to vulnerable groups.

Secondly, financial institutions must take social responsibility when providing services, put an end to non-performing financial products, prevent excessive lending, and in particular, strengthen customer protection in digital financial services.

Thirdly, financial capabilities need to be further improved. The financial health of households and micro-economies is closely related to their financial capabilities. The core content of financial health includes several indicators such as debt management, financial reserves, financial planning and the effective use of financial services, which requires consumers to be equipped with sound financial literacy, behaviors, attitudes and skills. Governments, financial institutions and the whole society should work together to build such capacity for customers.

Finally, increase the income level of vulnerable groups and micro-economies, as this is the only way that can improve the living standards while maintaining financial balance and strengthen the ability to resist any risk. Developing rural digital inclusive finance and creating a favorable policy environment can help micro-economies to transform from offline to online; the rural revitalization serves as a fundamental way to improve the financial health of rural residents and micro-economies.